The Statistical Pair Arbitrage Strategy

This is a strategy that exploits temporary price inefficiencies between two cryptocurrencies that statistically co-integrated or typically move in tandem. When the price relationship between these assets diverges from the norm, the algorithm detects this anomaly and executes trades to capitalize on the anticipated correction.

The development of the strategy involved a painstaking analysis of potential crypto asset pairs, employing a wide array of statistical and mathematical tools to sift through the vast crypto market. This rigorous selection process ensures we identify pairs that offer the most lucrative opportunities, simultaneously managing risk through inherent market correlation.

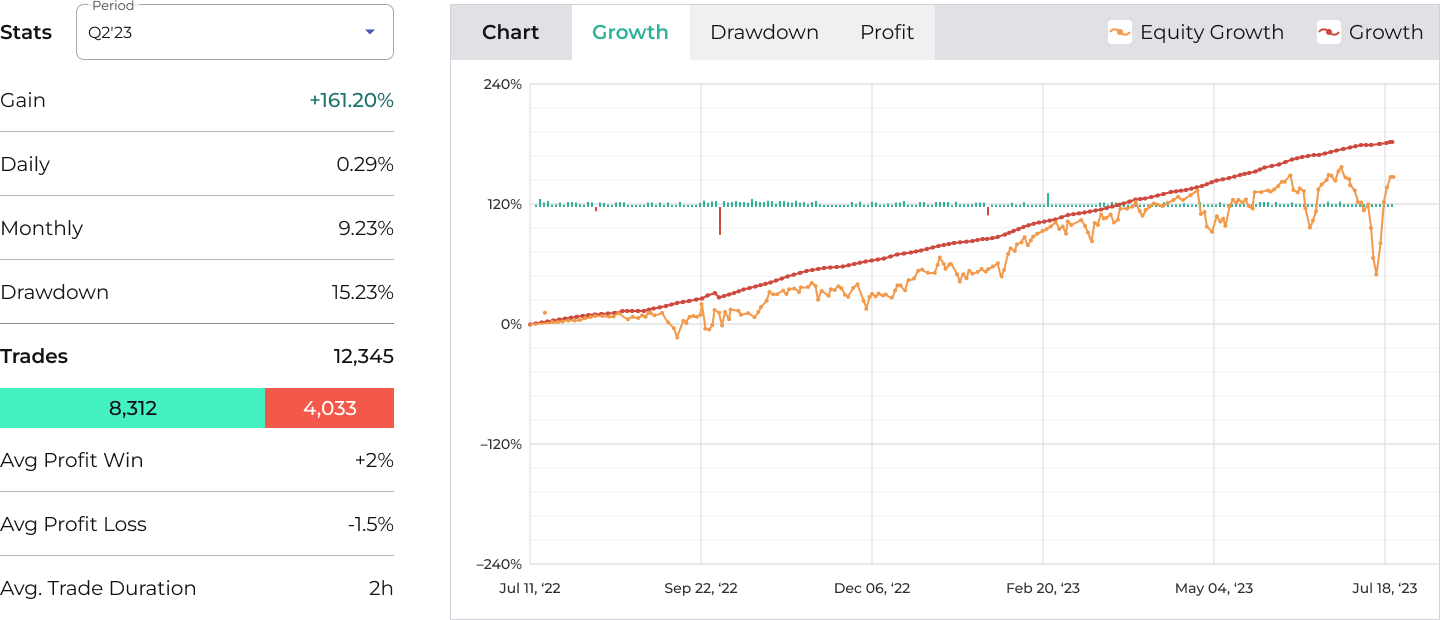

Performance

The Art and Science of Our Strategy

Key to the success of the strategy is the use of advanced technologies, including sophisticated financial modeling and advanced machine learning techniques.

The strategy combines a multitude of methodologies including:

- XGBoost: A powerful gradient boosting machine learning framework utilized for its speed and model performance. It has been carefully employed to find patterns and anomalies in the vast and complex cryptocurrency markets.

- Neural Networks: With the ability to learn and model non-linear and complex relationships, which is paramount in the unpredictable world of cryptocurrencies. Our proprietary neural network model is designed to identify profitable trade setups based on historical correlations and price deviations.

- ARIMA: A statistical method used for time-series forecasting, enabling the prediction of cryptocurrency prices based on their own past behavior. This allows us to anticipate possible future movements in the cryptocurrency pairs we trade.

The strategy was also subjected to rigorous backtesting, a process of applying models to historical data to assess their performance. Backtesting allows to test and refine the strategies and configure parameters before they are launched into the real-world trading environment.

We follow a rigorous, scientific process, combining elements of both data science and finance best practices